Guide to Learning About Personal Finance

Mastering Personal Finance: Practical Strategies for Budgeting and Debt Management

Crafting a Realistic Budget: Allocation and Tracking

Understanding Your Financial Inflows

The foundation of any solid budget begins with a thorough understanding of your income streams. This means looking beyond just your primary paycheck to include irregular earnings like freelance projects, rental income, or dividends from investments. Documenting these varied sources with their payment frequencies creates a complete financial picture, enabling smarter decisions about resource allocation.

I recommend maintaining a dedicated income ledger, whether digital or paper-based, where you record each payment as it arrives. This practice helps identify seasonal fluctuations and opportunities for income optimization that might otherwise go unnoticed.

Essential vs. Discretionary: The Spending Divide

Categorizing expenses requires honest evaluation of what truly constitutes a necessity. While housing and groceries clearly qualify, some subscriptions or memberships might belong in the discretionary column. The key is distinguishing between survival needs and lifestyle choices - a distinction that varies significantly between individuals.

When I worked with clients, we often discovered forgotten automatic payments for services they no longer used. Conducting this audit quarterly can reveal surprising opportunities for savings without impacting quality of life.

Strategic Allocation Methodology

The 50/30/20 rule provides a helpful framework: allocate 50% to needs, 30% to wants, and 20% to savings/debt repayment. However, these percentages should flex based on your specific circumstances. Someone with high medical expenses might need 60% for essentials, while another might temporarily allocate more to debt payoff.

Consider using envelope budgeting for variable expenses like groceries - physically dividing cash into categories creates tangible spending limits that digital transactions often lack.

Savings as a Non-Negotiable Expense

Treat savings contributions with the same urgency as rent payments. Automating transfers to savings accounts immediately after payday ensures consistency. Start small if necessary - even $20 weekly grows to over $1,000 annually, creating a valuable emergency buffer.

For goal-specific savings, separate accounts labeled Car Maintenance or Vacation Fund provide psychological reinforcement and prevent accidental spending of earmarked funds.

The Tracking Imperative

Modern budgeting apps sync with bank accounts to categorize spending automatically, but manual tracking for 30 days creates superior awareness. Carrying a small notebook to immediately record purchases reveals unconscious spending patterns that automated systems might miss.

Schedule bi-weekly budget reviews - not as punishment, but as an opportunity to celebrate progress and make minor course corrections before small issues become major problems.

Managing Debt Effectively: Strategies for Paying it Off

The Debt Inventory Process

Begin your debt management journey by creating a comprehensive debt inventory. List every obligation including medical bills, personal loans, and even money borrowed from family. This complete picture often motivates action more than vague awareness of being in debt. Include current balances, interest rates, and minimum payments to understand the true scope.

Color-coding debts by urgency (red for high-interest, yellow for medium, green for low) creates a visual prioritization system that makes decision-making more intuitive.

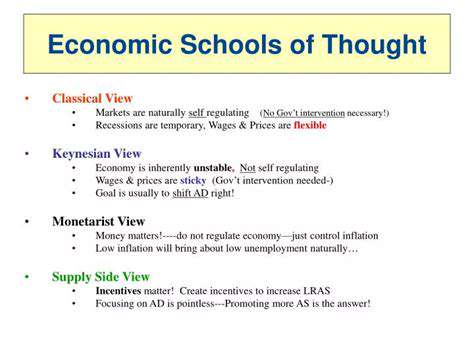

The Snowball vs. Avalanche Debate

Two primary debt repayment strategies exist: the debt snowball (paying smallest balances first for psychological wins) and the debt avalanche (targeting highest interest rates first for mathematical efficiency). The best method depends on your personality - some need quick victories while others prefer optimal financial outcomes.

I've found hybrid approaches effective: arrange debts by interest rate but make the first payoff a small balance high-interest debt. This combines mathematical efficiency with early motivation.

Strategic Payment Allocation

Beyond minimum payments, allocate any extra funds to your target debt. Even small additional payments create compound benefits by reducing principal faster. Consider using found money like tax refunds or bonuses for lump-sum payments on targeted debts.

A client once used their $200 monthly cable bill savings (after switching to streaming) to accelerate credit card payoff, eliminating $5,000 debt in 18 months through this single change.

The Negotiation Playbook

Creditors often prefer partial payment over none. Successful negotiation requires preparation: know your budget limits, research competitor rates, and practice your talking points. Call during business hours mid-week when representatives have more flexibility.

Document all agreements in writing and confirm any promised changes appear on subsequent statements. Many have successfully reduced interest rates by 5-10% through polite, persistent negotiation.

When to Seek Professional Help

Nonprofit credit counseling agencies offer free initial consultations to evaluate your situation. Signs you might need professional assistance include: using credit for basic living expenses, making only minimum payments, or experiencing collection calls. Certified counselors can often negotiate better terms than individuals.

Be wary of debt settlement companies promising unrealistic results - their fees often outweigh benefits and can damage credit further. Legitimate help shouldn't require upfront payments.

Building a Sustainable System

Create visual progress trackers - a simple chart showing debt reduction over time provides powerful motivation. Celebrate milestones (every $1,000 paid, or each debt eliminated) to maintain momentum. These small rewards reinforce positive behavior without undermining financial progress.

Remember that occasional setbacks are normal. The key is restarting quickly rather than abandoning the plan entirely. Sustainable debt management focuses on consistent progress, not perfection.

![Guide to Learning About [Specific Topic, e.g., Climate Change]](/static/images/31/2025-05/TheUnfoldingImpactsofaChangingClimate.jpg)